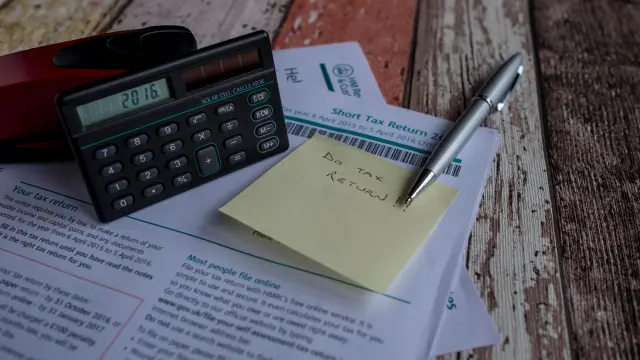

UK Self Assessment Tax Return

Self Assessment Tax and Level 5 Tax Accounting | CPD Certified | Exam & Assessments | 24x7 Instant Access

One Education

Summary

- Certificate of completion - £9

- Certificate of completion - £109

- Exam(s) / assessment(s) is included in price

- Tutor is available to students

Add to basket or enquire

Overview

*** Get an Extra 10% Off from Reed! ***

Enrol in our online course and gain the confidence to take your career to the next level.

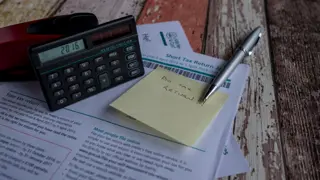

If you are self-employed or a company director in the UK, you are required by law to complete a Self Assessment Tax Return (SATR). This can be a daunting and time-consuming task, especially if you need to become more familiar with the UK tax system. Our UK Self Assessment Tax Return course will give you the knowledge and confidence to complete your SATR, ensuring that you pay the correct amount of tax.

The Self Assessment tax return is a form that individuals in the United Kingdom who are self-employed or have certain other sources of income must use to declare their income and calculate their tax liability. The return must be filed annually, and taxpayers who do not file their return on time may be penalised. The UK Self Assessment Tax Return course offers a range of benefits for those who wish to learn more about the UK tax system and how to comply with their tax obligations.

The UK Self Assessment Tax Return course overviews the self-assessment tax return process and helps participants understand the critical deadlines and requirements. The course also covers a range of topics, such as tax allowances, tax reliefs, and tax deductions. Moreover, our UK Self Assessment Tax Return course helps participants identify the most efficient way to complete their tax returns. This comprehensive UK Self Assessment Tax Return course is designed for individuals and businesses to learn about the UK tax system and how to comply with self-assessment tax return requirements.

Is this course for you? This course is ideal if you are self-employed or a company director in the UK and you need to complete a self-assessment tax.

So why wait? Enrol in our UK Self Assessment Tax Return course right now!

Learning Outcomes

- Understand what a self-assessment tax return is and who needs to complete one.

- Understand how to register for the HMRC self-assessment.

- Understand what information needs to be included in a self-assessment tax return.

- Know how to calculate your tax liability.

- Understand how to make payments towards your self-assessment tax return.

- Know the deadlines for completing and submitting your self-assessment tax return.

- Understand the penalties for late submission or payment of your self-assessment tax return.

Key Benefits

- Learning materials of the Design course contain engaging voice-over and visual elements for your comfort.

- Get 24/7 access to all content for a full year.

- Each of our students gets full tutor support on weekdays (Monday to Friday)

Achievement

CPD

Course media

Description

Module Attributes:

The course has been meticulously designed to deliver maximum information in minimum time. This approach enables students to easily comprehend the core concepts and confidently apply them to diverse real-life scenarios.

Course Curriculum Breakdown:

Course 01: Tax Accounting

- Module 01: Tax System and Administration in the UK

- Module 02: Tax on Individuals

- Module 03: National Insurance

- Module 04: How to Submit a Self-Assessment Tax Return

- Module 05: Fundamentals of Income Tax

- Module 06: Advanced Income Tax

- Module 07: Payee, Payroll and Wages

- Module 08: Capital Gain Tax

- Module 09: Value Added Tax

- Module 10: Import and Export

- Module 11: Corporation Tax

- Module 12: Inheritance Tax

- Module 13: Double Entry Accounting

- Module 14: Management Accounting and Financial Analysis

- Module 15: Career as a Tax Accountant in the UK

Course 02: Self Assessment and Tax Return Filling UK

- Module 01

01: Introduction to Self Assessment

02: Logging into the HMRC System

03: Fill in the Self Assessment Return - Module 02

01: Viewing the Calculation

02: Submitting the Assessment

03: Conclusion

How is the UK Self Assessment Tax Return course assessed?

To simplify the procedure of evaluation and accreditation for learners, we provide an automated assessment system. Upon completion of an online module, you will immediately be given access to a specifically crafted MCQ test. The results will be evaluated instantly, and the score displayed for your perusal. For each test, the pass mark will be set to 60%.

When all tests have been successfully passed, you will be able to order a certificate endorsed by the Quality Licence Scheme.

Who is this course for?

This Course is ideal for

- UK-based entrepreneurs

- Those in the UK who must file a self assessment tax return

- Students studying accounting and independent contractors who need to file a UK self assessment tax return and wish to learn more about the procedure.

Requirements

There are no specific prerequisites to enrol in this course.

Career path

Many opportunities are also available for those interested in working in this field.

- Personal Tax Senior

- Trainee Accountant, Tax

- in-house tax accountant

- Assistant Manager of Personal Taxes

- Tax Senior

In the United Kingdom, the average salary in this industry ranges from £40,375 to £48,080.

Questions and answers

What happens if I do not complete the course within a year? Will any extensions be given?

Answer:Dear RK, Thank you for your question. Yes, an extension option is available if you need more time to complete the course.

This was helpful.After completion of this course, would I be able to submit tax returns? Or would I need to do additional courses?

Answer:Dear Melissa, Thank you for your question. Yes, Self-Assessment Tax Return is covered in this course. Thanks

This was helpful.Can you confirm the course duration and how is the course material studied by the learner

Answer:Dear Learner, Thank you for contacting us. The estimated course duration is 380 hours. However, you will get one year access to the course after purchasing, and you can complete it anytime within a year. All of our course materials are online and you can study everything online as well. Stay Safe Stay Healthy.

This was helpful.

Certificates

Certificate of completion

Digital certificate - £9

Certificate of completion

Hard copy certificate - £109

QLS Endorsed Certificate

Hardcopy of this certificate of achievement endorsed by the Quality Licence Scheme can be ordered and received straight to your home by post, by paying —

- Within the UK: £109

- International: £109 + £10 (postal charge) = £119

CPD Accredited Certification from One Education

- Hardcopy Certificate (within the UK): £15

- Hardcopy Certificate (international): £15 + £10 (postal charge) = £25

Reviews

Legal information

This course is advertised on reed.co.uk by the Course Provider, whose terms and conditions apply. Purchases are made directly from the Course Provider, and as such, content and materials are supplied by the Course Provider directly. Reed is acting as agent and not reseller in relation to this course. Reed's only responsibility is to facilitate your payment for the course. It is your responsibility to review and agree to the Course Provider's terms and conditions and satisfy yourself as to the suitability of the course you intend to purchase. Reed will not have any responsibility for the content of the course and/or associated materials.